Welcome to Resolve Right

YOUR TRUSTED PARTNER ON THE PATH TO DEBT FREEDOM

Our expert team will assist you in regaining your lost happiness by giving you a debt-free life and protecting against creditor’s harassment

About Us

In India, we understand that financial hardships can often feel overwhelming. But with our advanced solutions and expert consultation, we’re here to guide you towards a brighter financial future.

In today’s world, where the global pandemic has exacerbated economic uncertainties, many individuals find themselves struggling with loan repayments, facing the daunting prospect of defaulting on EMIs. At Resolve Right, we recognize the toll this can take on your finances and peace of mind. That’s why we specialize in providing loan settlement and debt settlement services tailored to your unique circumstances.

Why Choose Us

Cost-Effective Solutions

We present inventive fintech solutions alongside seasoned debt settlement services crafted to deliver economic relief to individuals weighed down by debt.

Consumer Advocacy

We stand as a staunch advocate for consumer rights, particularly attuned to the financial adversities. Our unwavering commitment lies in safeguarding our client’s interests and ensuring equitable treatment from creditors.

Expert Guidance

Our cadre of legal specialist offers tailored guidance and bespoke financial strategies, aiding clients in charting a course towards financial liberation.

Proven Track Record

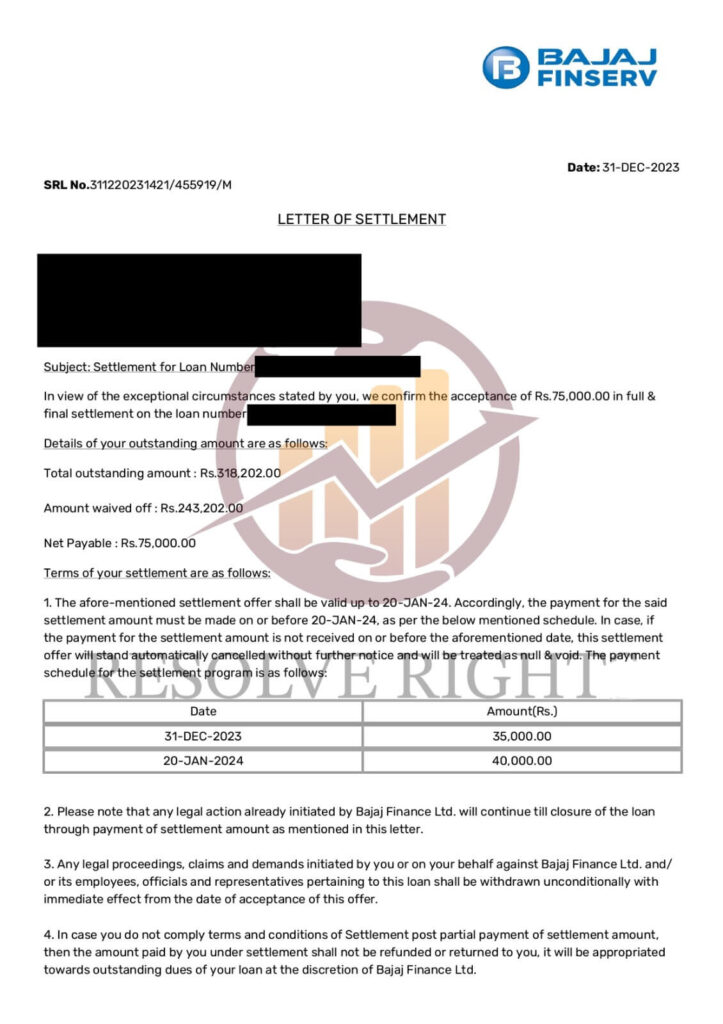

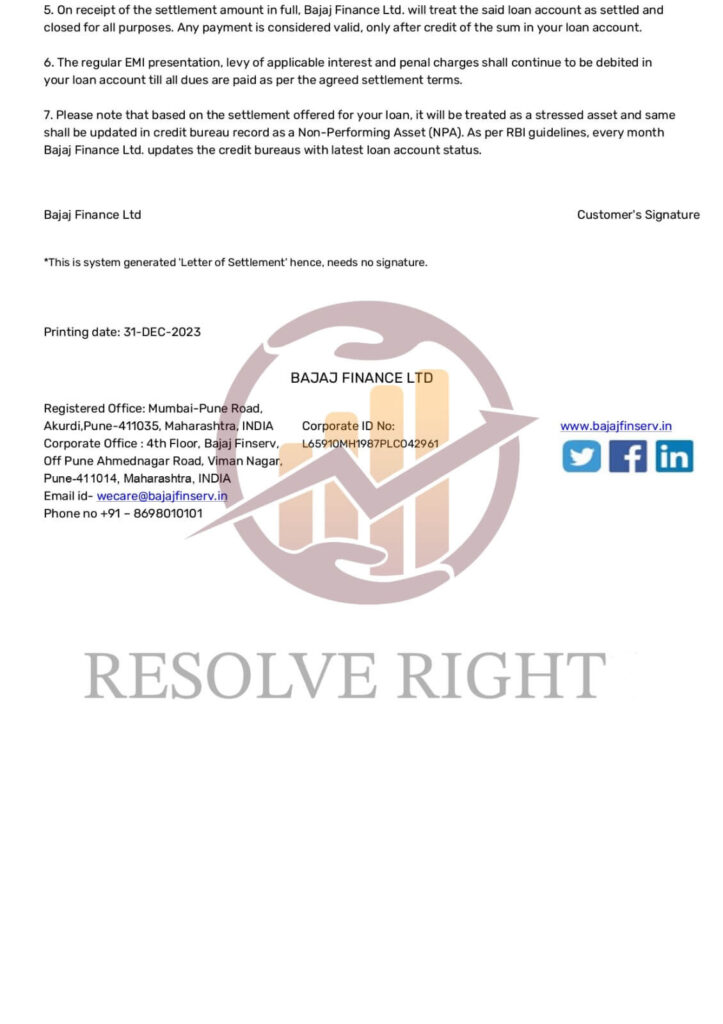

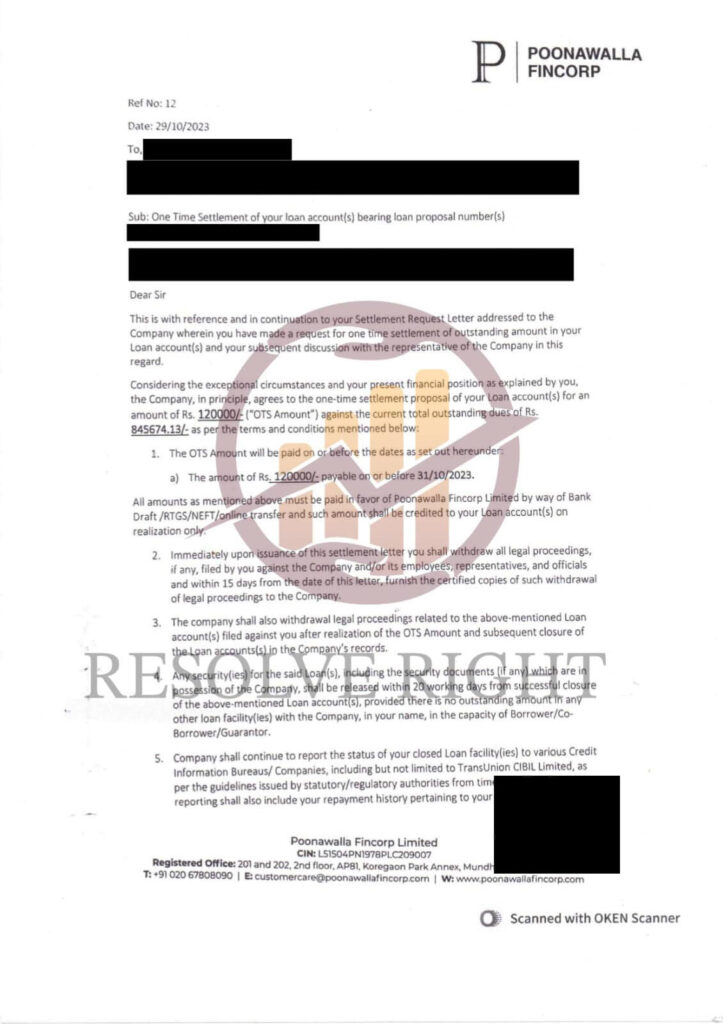

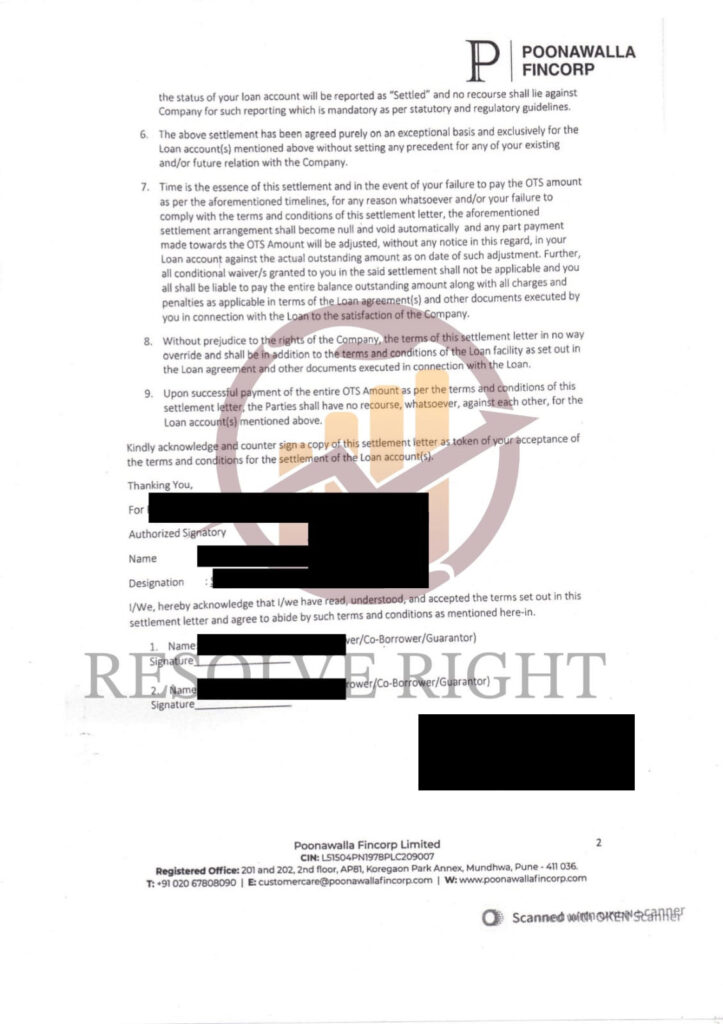

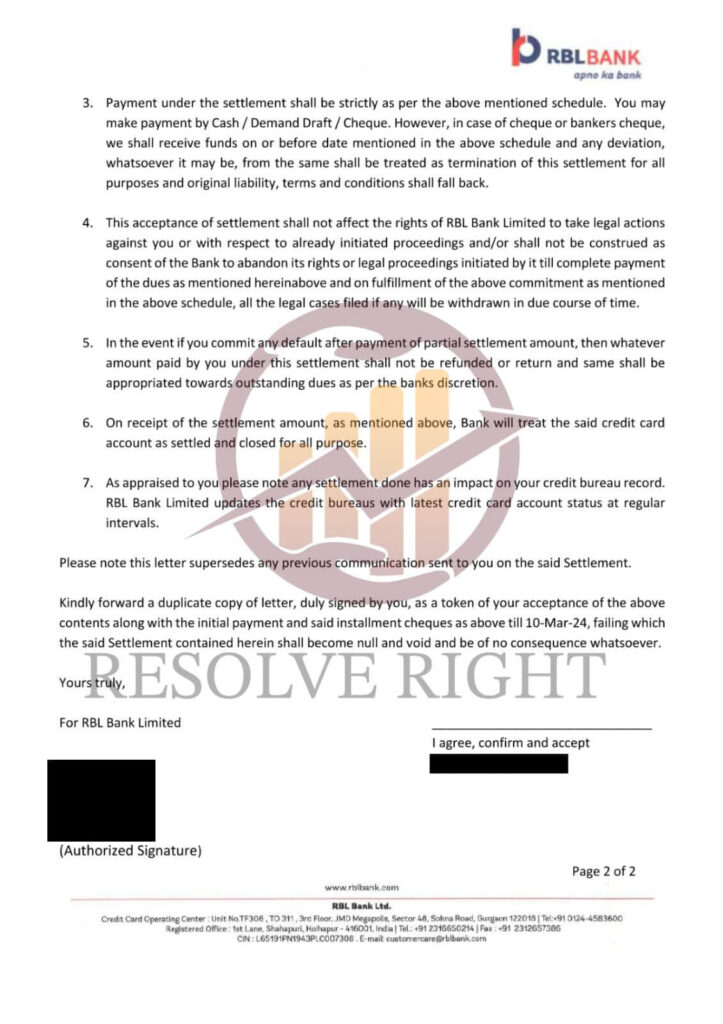

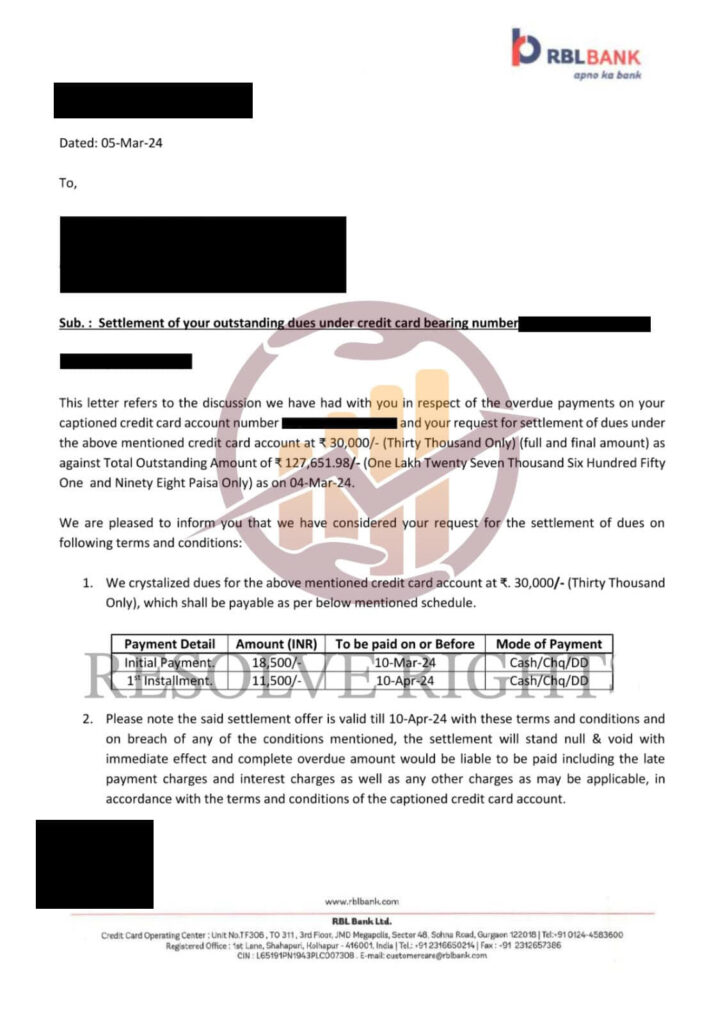

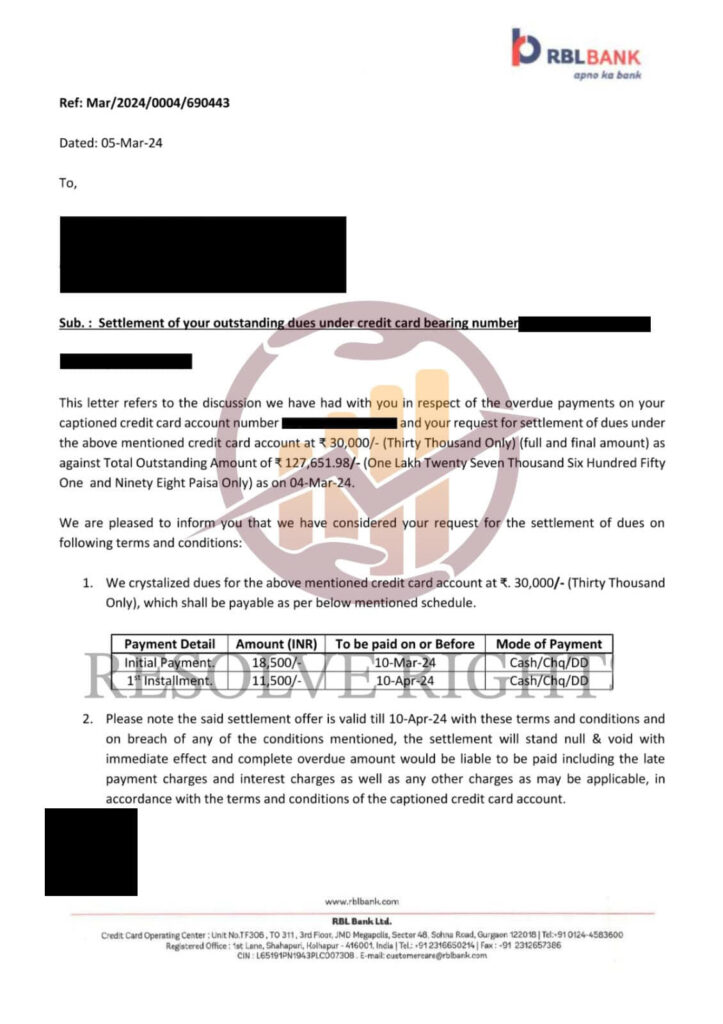

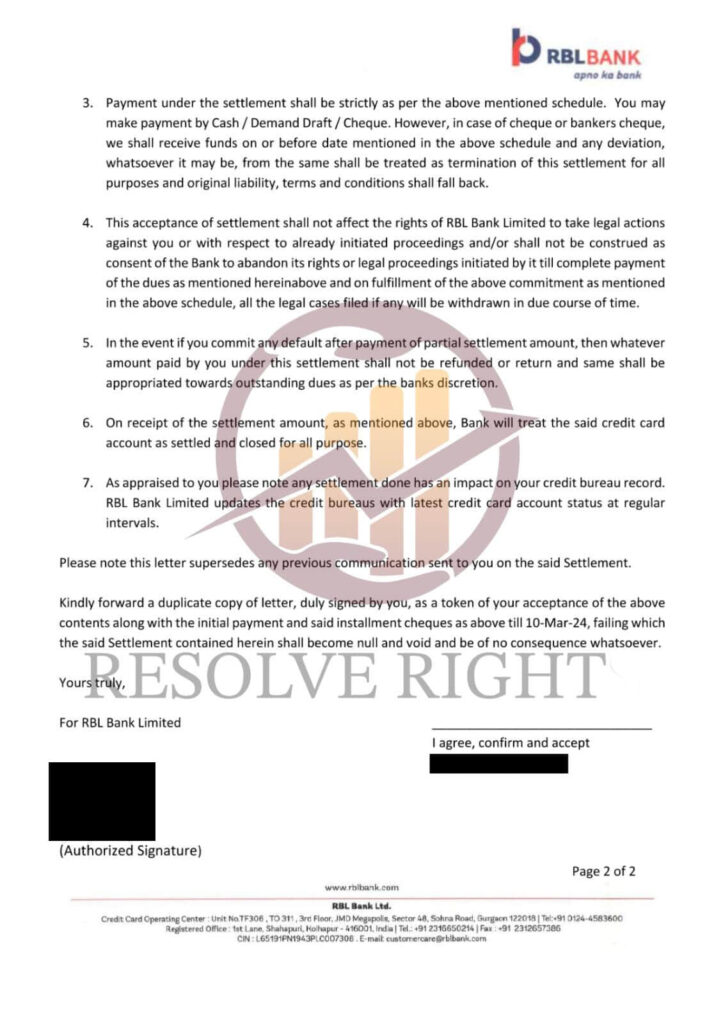

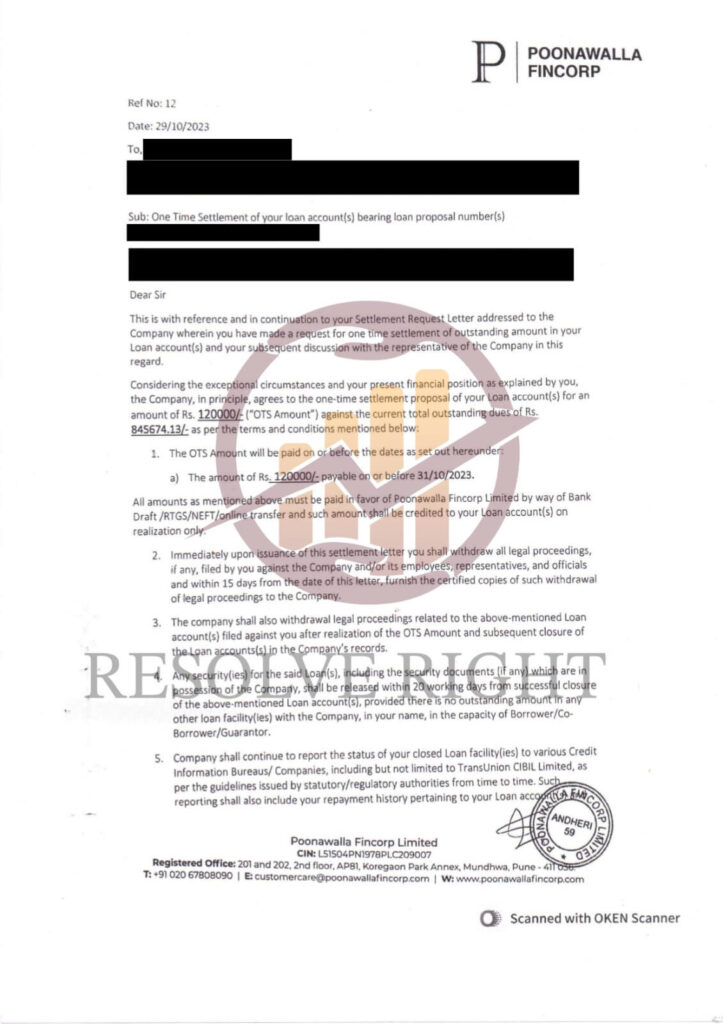

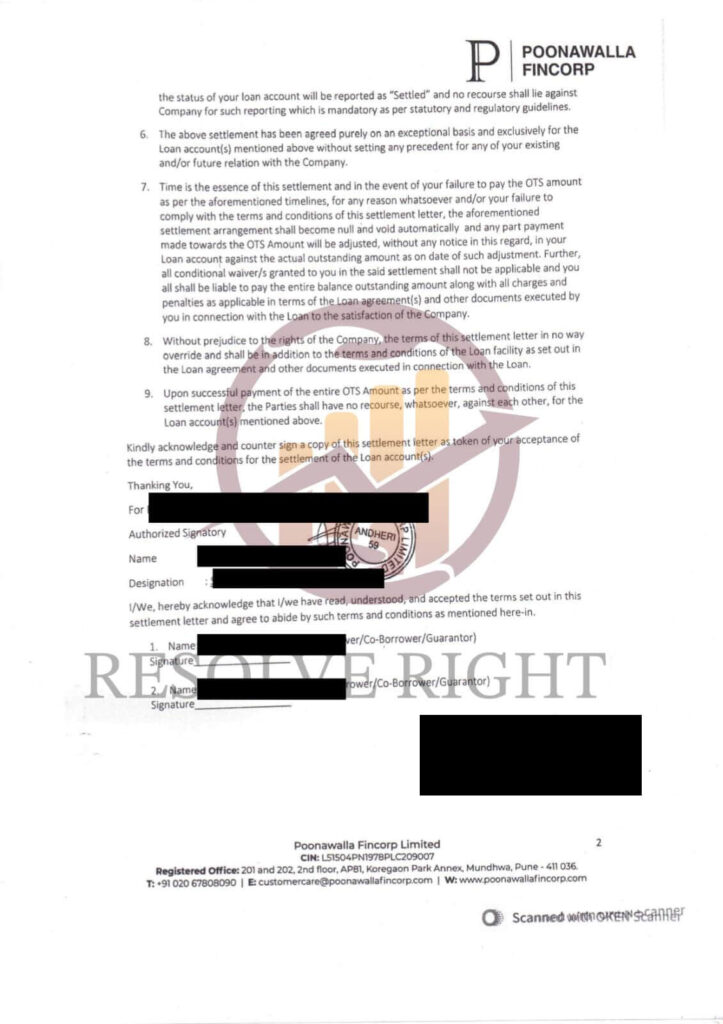

With a commendable history of settling loan accounts, Resolve Right has garnered recognition as a reputable and efficacious debt relief entity in India.

Our Services

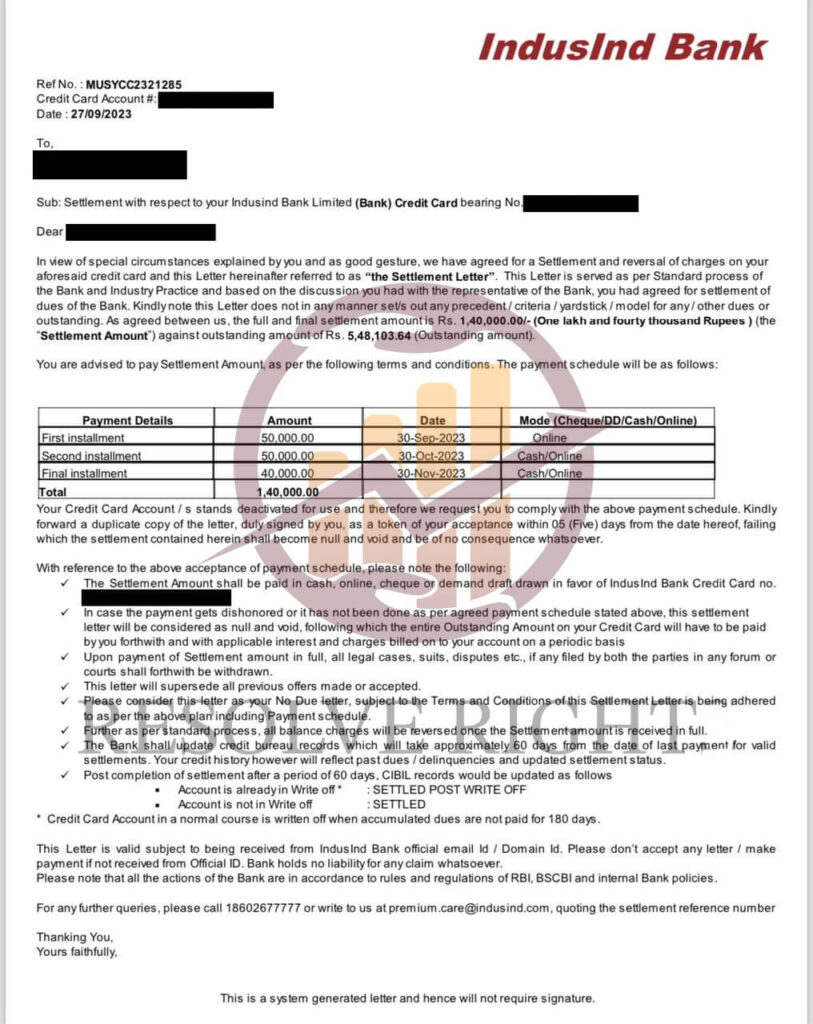

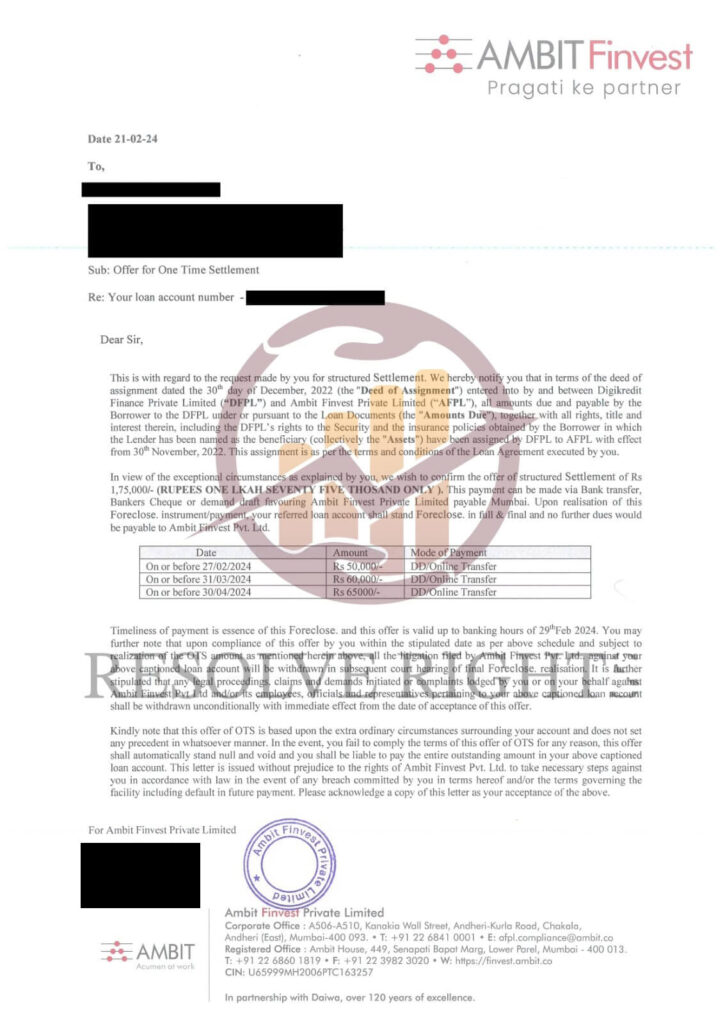

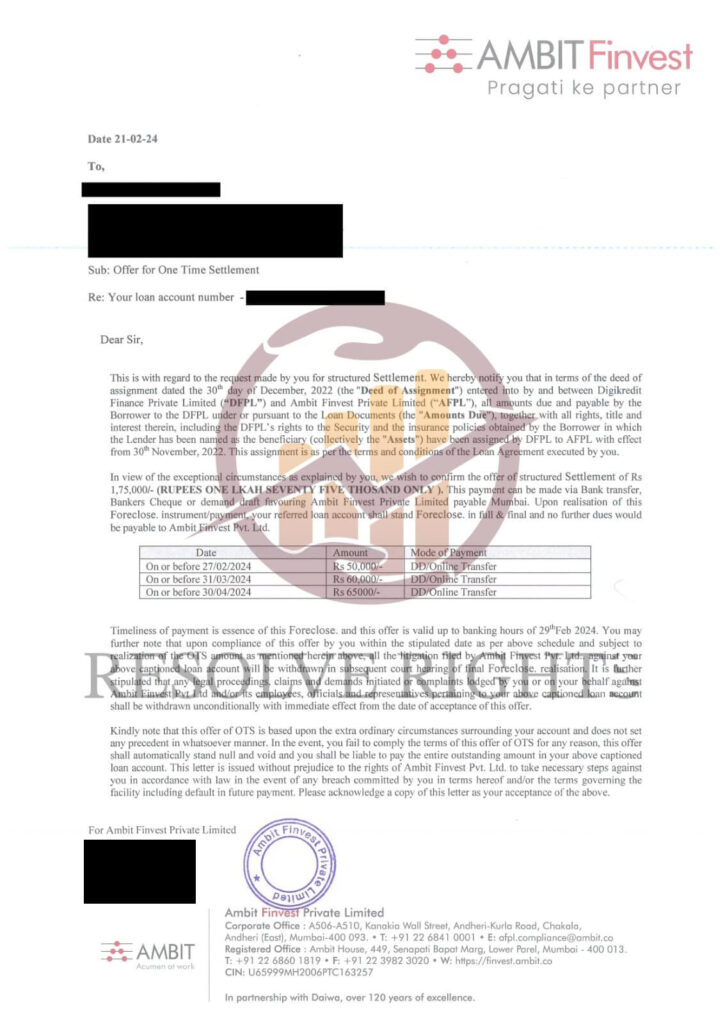

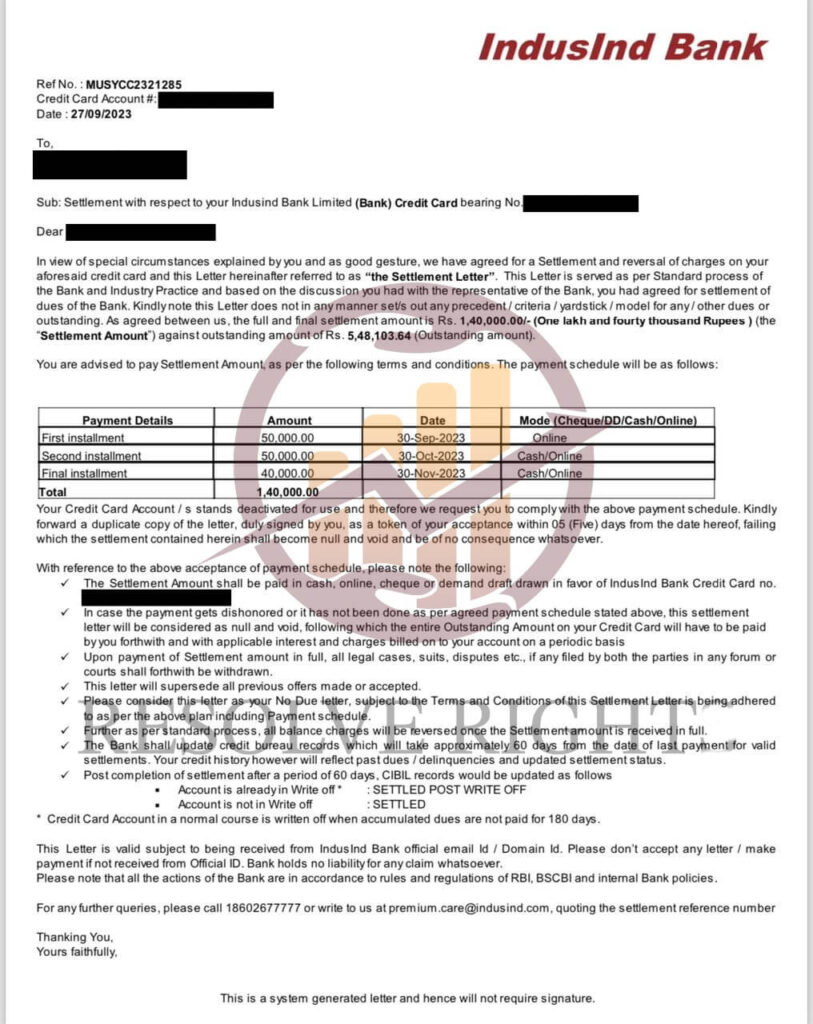

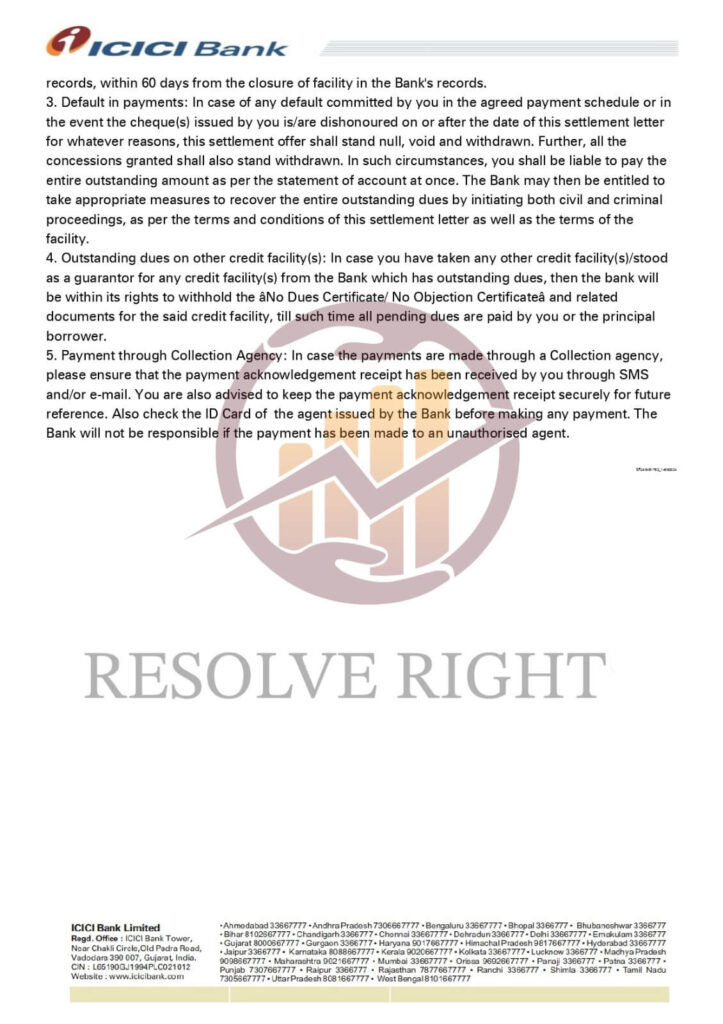

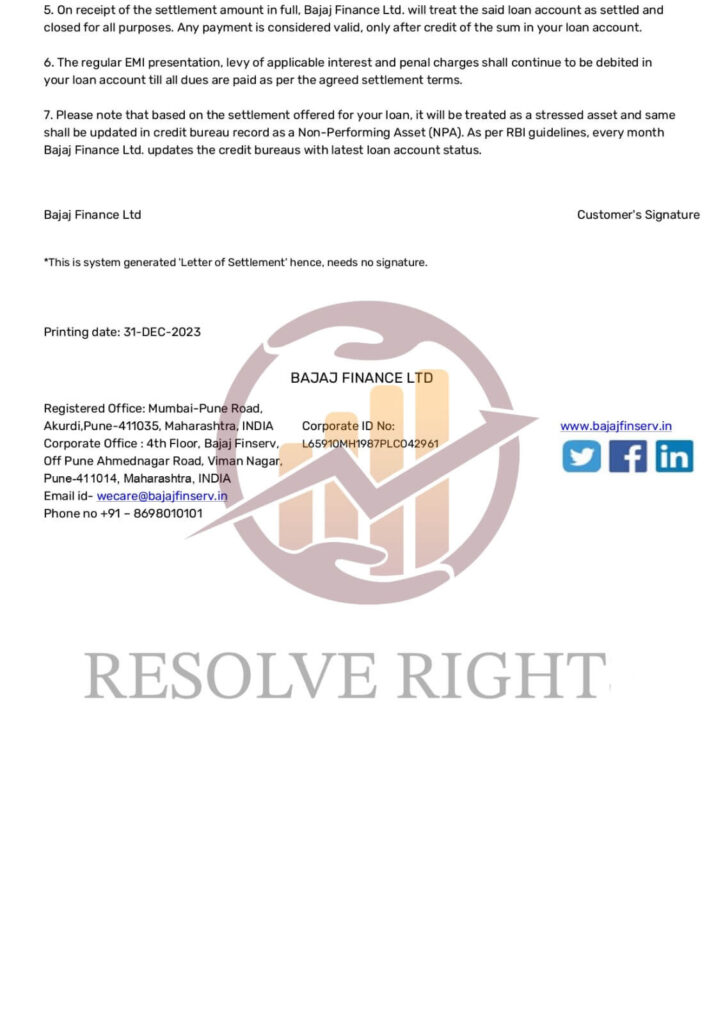

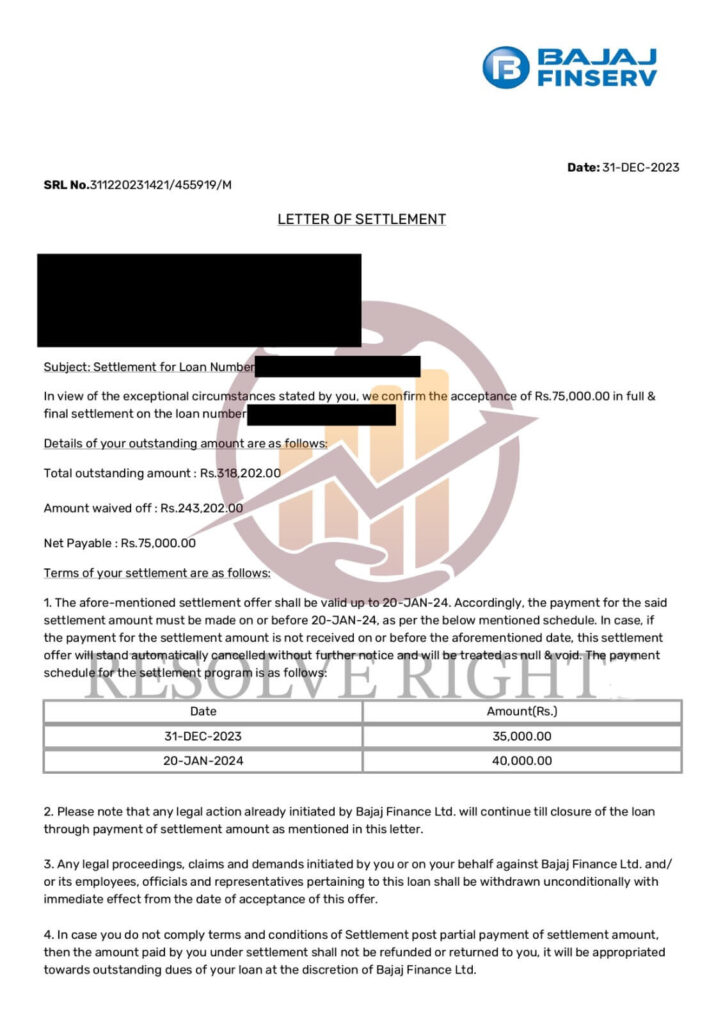

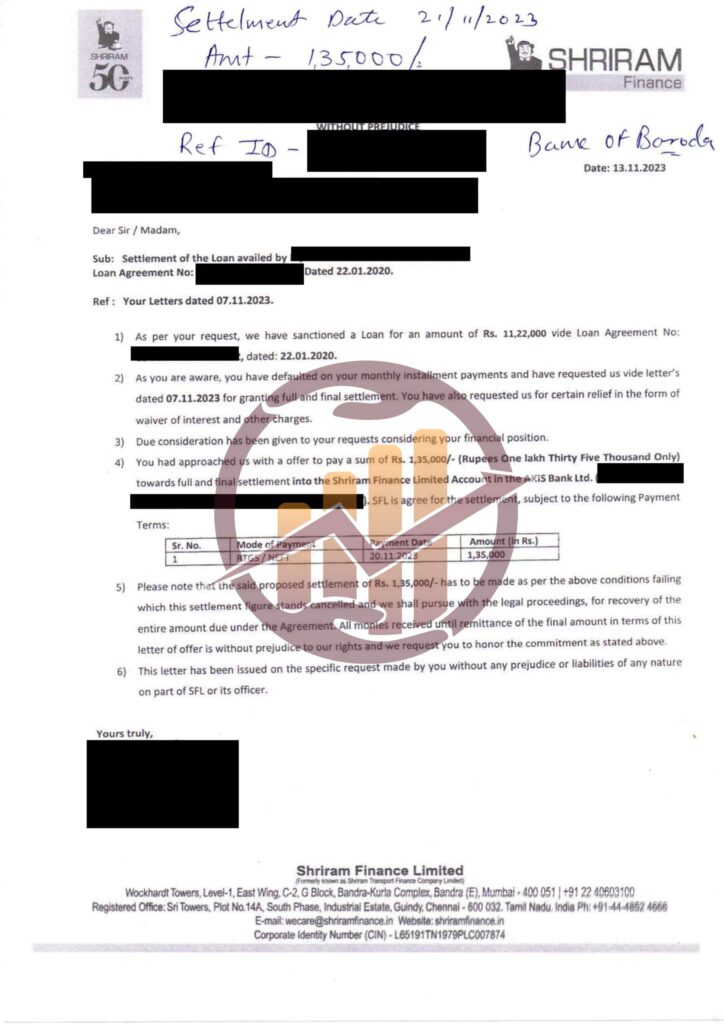

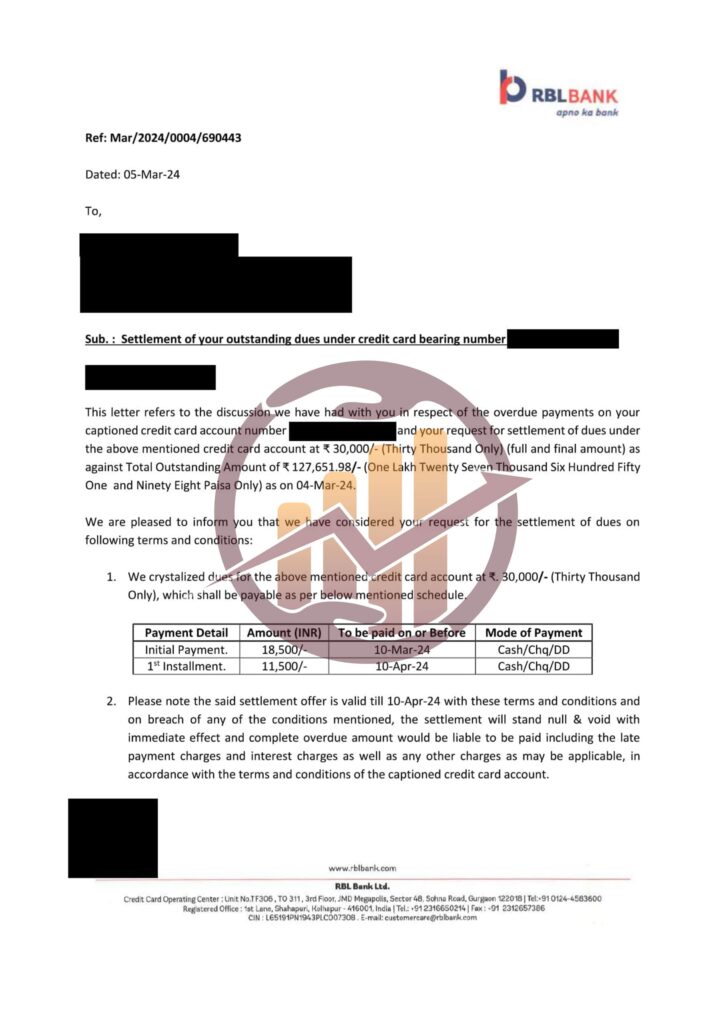

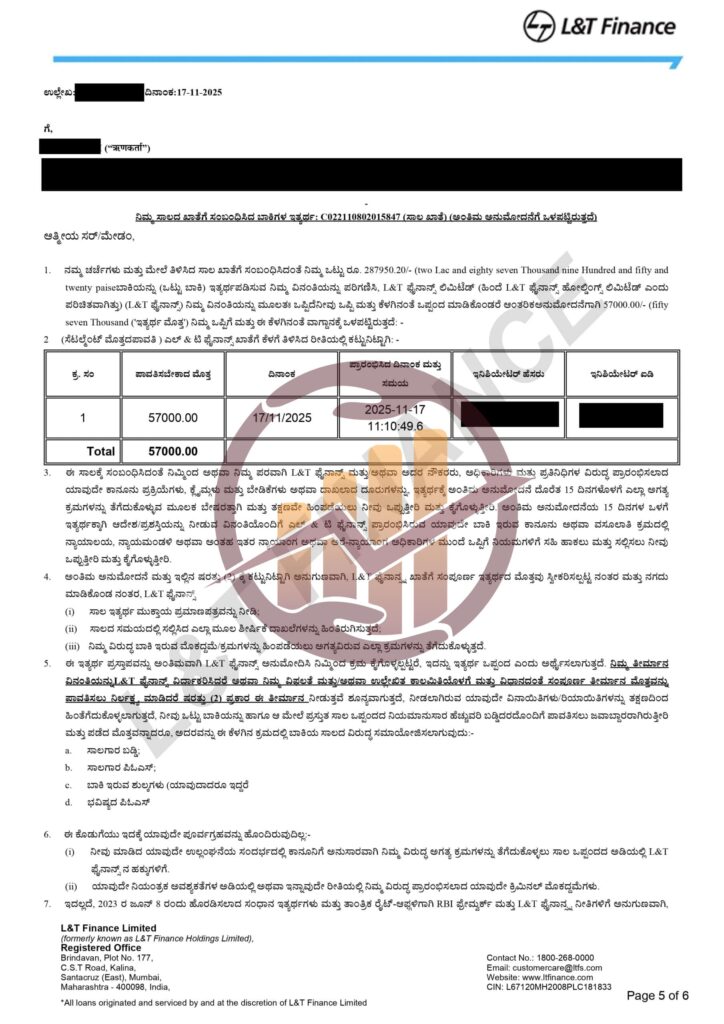

Debt Settlement Program

- Personal Loan

- Credit Card Loan

- Vehicle Loan

- Business loan

- Education Loan

- Home loan

Anti Harassment Services

- A dedicated call-forwarding number activated within 10 minutes

- All lender & agent calls redirected to our trained team

- Intervention against threats, abusive behaviour, or illegal pressure

- Prevention of unauthorised home/workplace visits

- Shield of privacy protection.

Debt Consolidation Program

- Lower interest: Often reduces overall interest, saving money over time.

- Improves cash flow: Lower monthly payments leave more room in your budget.

- Reduces stress: Fewer reminders, fewer penalties, more peace of mind.

- Credit score support: Timely single payments can gradually improve your credit profile.

Dispute & Arbitration Handling

- Filing objections against biased arbitration demands

- Drafting strong, legally sound replies

- Representing you throughout the arbitration process

- Negotiating balanced settlements through conciliation or mediation.

Legal Consultancy and Support

- Expert Guidance: Access to experienced legal professionals for accurate advice.

- Time and Cost Saving: Avoids costly mistakes and lengthy disputes.

- Customized Solutions: Legal strategies tailored to your specific needs.

- Ongoing Support: Assistance from consultation to resolution.

- Peace of Mind: Confidence in making informed legal decisions.

FAQs

What kind of loans can be settled through Resolve Right?

Resolve Right help in settling both Unsecured and secured loans like credit card loans, personal loans, consumer loans, business loans, home loans, vehicle loans and education loans, etc.

How much time it takes to settle the loan?

Settling the loan may vary on your savings but usually, it takes atleast 3 months.

Will I be charged interest and late fees on my loans?

How do I handle the calls from the bank or recovery agent?

What happens if the lender takes legal action against me?

The creditor has the right to file a case for non-payment of dues but our legal team will help you in handling such cases in order to achieve the goal of finacncial freeom.

How We Work

STEP 1

Assessing Your

Financial Landscape

STEP 2

Tailored Strategies

for Your Needs

STEP 3

Advocating on

Your Behalf

STEP 4

Achieving Substantial

Debt Reductions

Testimonials

Mr. Aditya Roy (Kolkata)

Advocate Mayank handled my Axis Bank settlement professionally and smoothly. Highly recommended.

Mr. Soman (Mumbai)

Resolve Right successfully reduced my Kotak Mahindra Bank loan and guided me with consistent, timely updates.

Ms. Kez Bhaskar (Andhra Pradesh)

Resolve Right’s expertise helped secure a favorable settlement with HDFC. Their supportive and responsive team made the process much easier.

Mrs. Kavitha Murthy (Bangalore)

Resolve Right handled my SBI loan settlement efficiently and reduced my financial burden. Their clear communication and regular follow-ups were very helpful.

Mr. Jairam Naidu (Mumbai)

Resolve Right successfully negotiated my ICICI Bank settlement and guided me with timely updates. I’ve received my NOC and am confident about resolving the remaining issues.

Gain Financial Freedom and Partner with India’s Foremost Debt Resolution Experts for a Stress-Free Life